Configuring Sales Tax

patientNOW uses the Service Facility to calculate sales tax on a Quote or Invoice because each facility may be subject to different sales tax localities.

Note: patientNOW only allows for 2 taxes to be applied to each transaction. If you have more than 2 tax authorities, you will need to combine 2 of them into one.

There are 4 steps to configure Sales Tax.

Add the Tax Type(s) to the Service Facility

Configure Tax Default on Procedures

Configure Tax Default on Products

Note: This page includes generic Add, Edit, and Disable Functionality

- Add New: opens a new record at the bottom of the window with all of the fields empty. Please carefully review the existing descriptions to see if one of them may work BEFORE adding a description to the system

- Add as New: must be selected to save the information after completing the empty Add New screen. May be selected when an existing record is in focus and you wish to create a copy of that record instead of creating a new, blank record.

- Save Modifications: must be selected when you have made changes to an existing record and you wish to save the changes.

- Disable: select the disable checkbox and select Save Modifications.

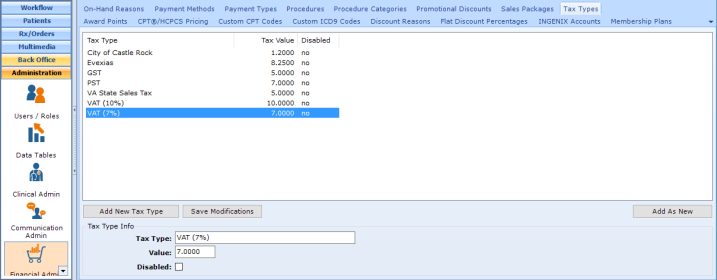

Configure Tax Types

Navigate to Administration | Financial Admin, Tax Types tab.

Select Add New Tax Type and enter the following.

- Tax Type. A description of the tax (e.g. Colorado State Tax)

- Value. This is the % of the tax (e.g. 3.5% tax would be entered as 3.50).

Warning: patientNOW does not allow you to delete configuration items because they may already be assigned to a patient. However, you may disable them so that they will not appear in patientNOW in order to be selected.

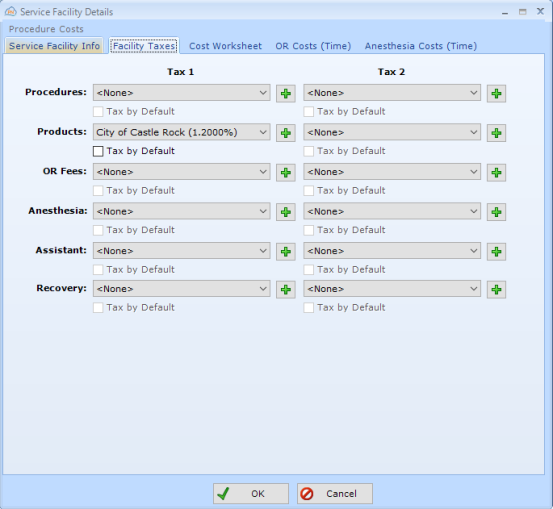

Add the Tax Type(s) to the Service Facility

Navigate to Back Office | People/Places, Service Facilities tab.

Select the service facility in the upper window and select Service Facility Details.

Select Facility Taxes tab at top.

Note: If the correct Tax Types do not appear in the pull-down next to each section, you may click on the green + sign to add a Tax Type to the system. Warning: since there are significant financial and legal issues with collecting and paying Sales Tax, it is recommended that only an administrator add them to the system.

For Procedures:

Select Tax 1. If you wish ALL procedures added to a quote or invoice to have this tax applied, select the Tax by default check box underneath.

Select Tax 2. If you wish ALL procedures added to a quote or invoice to have this tax applied, select the Tax by default check box underneath.

For Product:

Select Tax 1. If you wish ALL products added to a quote or invoice to have this tax applied, select the Tax by default check box underneath.

Select Tax 2. If you wish ALL products added to a quote or invoice to have this tax applied, select the Tax by default check box underneath.

For OR Fees:

Select Tax 1. If you wish ALL operating room fees added to a quote or invoice to have this tax applied, select the Tax by default check box underneath.

Select Tax 2. If you wish ALL operating room fees added to a quote or invoice to have this tax applied, select the Tax by default check box underneath.

For Anesthesia:

Select Tax 1. If you wish ALL anesthesia fees added to a quote or invoice to have this tax applied, select the Tax by default check box underneath.

Select Tax 2. If you wish ALL anesthesia fees added to a quote or invoice to have this tax applied, select the Tax by default check box underneath.

For Assistant:

Select Tax 1. If you wish ALL assistant fees added to a quote or invoice to have this tax applied, select the Tax by default check box underneath.

Select Tax 2. If you wish ALL assistant fees added to a quote or invoice to have this tax applied, select the Tax by default check box underneath.

For Recovery:

Select Tax 1. If you wish ALL recovery fees added to a quote or invoice to have this tax applied, select the Tax by default check box underneath.

Select Tax 2. If you wish ALL recovery fees added to a quote or invoice to have this tax applied, select the Tax by default check box underneath.